Greed & Fear:

In the stock market, there are basically two phases, greed and fear. When the stock market is going up, many investors allow greed to be a big part of their decision making. When the stock market is going down, those same investers tend to use fear to dictate decisions.

Greed:

When in the greed phase, the stock market is in an upward trend, and the S&P 500 is above its 50 day simple moving average.In this phase, we opt to own a combination of the Magnificent Seven stocks and their ETN's as shown on the main page of this website. We watch interest rates, business news, and world news. However, we stay fully invested. When enough events concern the investors, the S&P 500 will drop below its 50 day SMA. That is when we go to the side lines.

Fear:

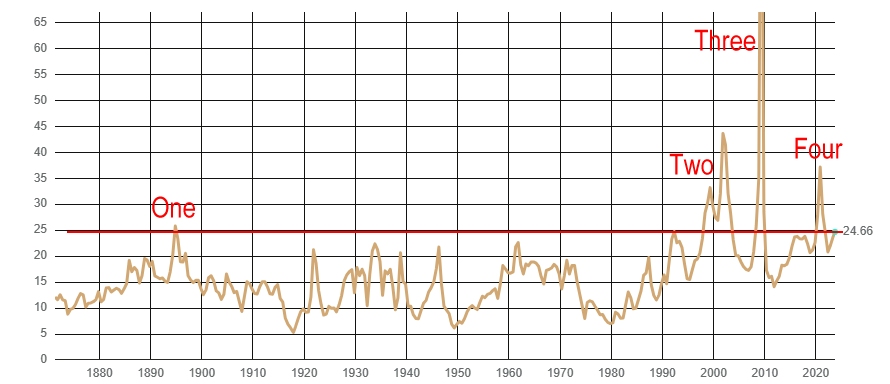

When in the fear phase, the stock market is in a downward trend, and the S&P 500 is below its 50 day simple moving average. The first action required is to go to the sidelines to protect the portfolio from disaster. Then comes the critical work of analyzing market and individual stock fundamentals as well as interest rates and world events, all of which have a significant impact on our market.The current P/E ratio of the S&P 500 is high. Very high. Investing in the stock market can be compared with ice skating on a frozen lake. As the P/E ratio goes higher, the ice gets thinner, which means a disaster could occur.According to the website, multpl.com, the S&P 500 P/E has only been this high or higher four times in history:

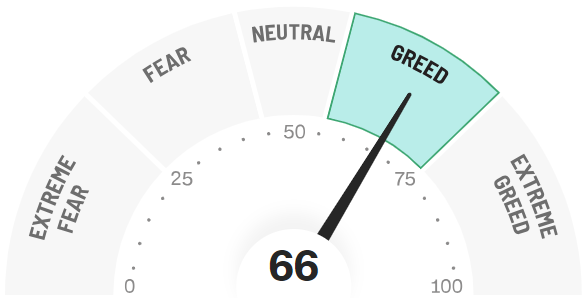

CNN's Fear and Greed Index

CNN's Fear & Greed Index is a more complex tool to calculate the tone of the stock market.

You may click here to view the current index.

Warning: Investing in the stock market is dangerous. You can and will lose money. We are not giving advice. We are simply documenting our strategy. Please consult a professional before making any investment decisions. You may click here for a full disclosure document. Thank you.

We've been told our URL is hard to type. If so, please try one of our mirror URL's: